Innovative Solutions for Extraordinary Financial Services

Personalize every interaction for today’s consumer

Every modern financial services company must also function as a technology company. Customers want competitive financial products delivered through convenient digital channels. Rulesware pairs our deep understanding of today’s banking and financing operations with our trusted expertise – creating compelling solutions that captivate customers.

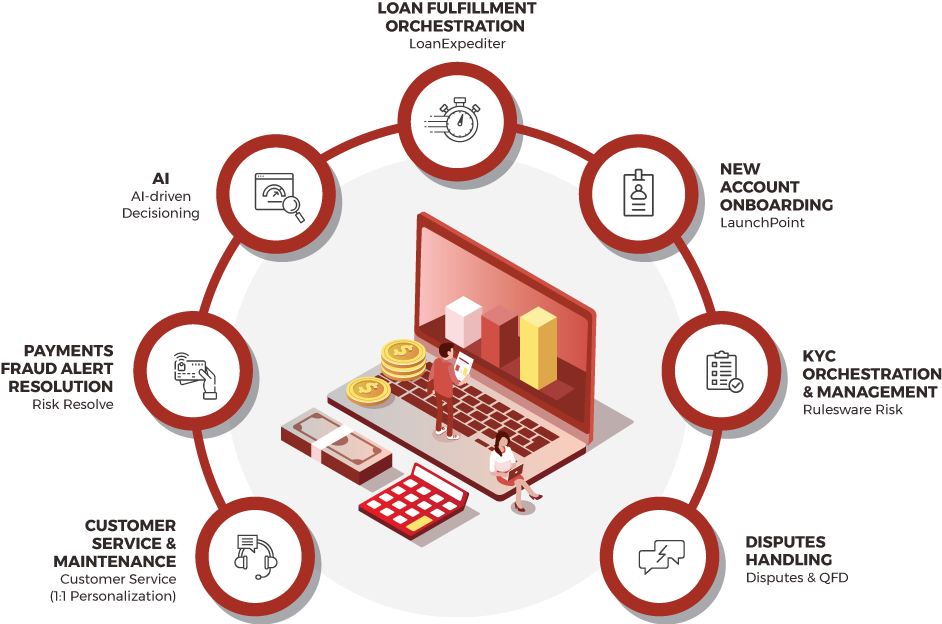

New Account Onboarding

LaunchPoint

Loan Fulfillment Orchestration

LoanExpediter

KYC Orchestration & Management

Rulesware Risk

DISPUTE HANDLING

Disputes & QFD

AI

AI-Driven Decisioning

Payments Fraud Alert Resolution

Risk Resolve

Customer Service & Maintenance

Customer Service (1:1 Personalization)

Rulesware harnesses digital innovation to help banking and financial institutions achieve:

Faster, Cost-Effective Operations

Automation accelerates workflows, eliminates manual tasks, and optimizes staffing models

Streamlined Compliance

Comprehensive reporting and processes with transaction tracking reduce risk for cost savings – and more successful audits.

Sophisticated Borrower Journeys

Fast, convenient lending and onboarding tools maximize customer enrollment, retention rates, and lifetime revenue.

Better Business Outcomes

Rulesware puts customers first, designing solutions tailored to your business vision and desired outcomes.

"We are extremely satisfied with the delivery provided by Rulesware. We have driven increased value within our applications, and this is in large part due to the quality of service and commitment to execution shown by the Rulesware team."

Financial Solutions

LoanExpediter

LoanExpediter™ unlocks digital transformation by simplifying and automating daily lending operations

LaunchPoint

Turn Onboarding Into a Loyal and Profitable Relationship

Disputes

Design Develop and Deploy Dispute Solutions