LaunchPoint™

- Onboard new customers in 20 minutes

- Create exceptional customer journeys

- Automate risk assessments

Learn the 3 Critical Rules for Successful Onboarding

Create simpler and smarter digital banking experiences

Turn digital banking into customer loyalty

LaunchPoint, the next-generation onboarding and risk management solution, gives you the fastest new account cycle in the industry – and the best personalized digital banking tools.

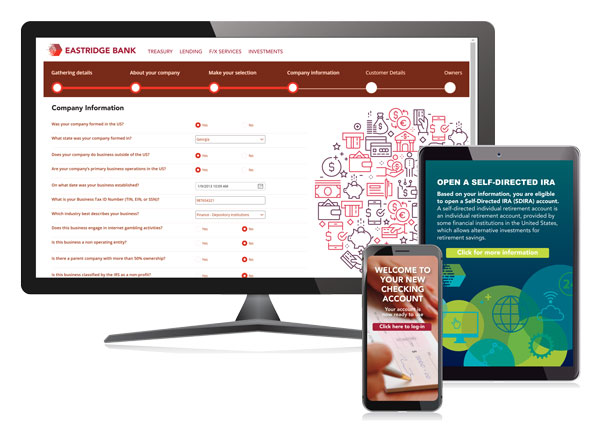

New customers go from application to funded account in 20 minutes. Existing customers stay for the services that match their financial journey.

One-and-Done Onboarding Process

Instead of making new customers wait a day or longer, LaunchPoint gives consumers the speed and freedom to use their account in just minutes.

Strong Customer Loyalty and Retention

Customers can enroll anywhere, anytime – online, in branch, or on mobile – while LaunchPoint’s rules engine recommends the right products.

A Richer Onboarding Funnel

Customers are more likely to complete their onboarding experience, with a 25%+ increase in full-account enrollment and funding.

Fast, Automated Risk Assessments

Automated decisioning reduces manual work and legacy systems, while providing real-time decisions with clear visibility for regulators and auditors.

Simplicity, Agility and Efficiency

LaunchPoint provides one universal system for commercial, personal, retail, and online accounts - reducing the complexity of multiple platforms.

in "Digital Transformation in Commercial Banking"

Increasing Market Share with Digital Onboarding

To attract and retain online and mobile banking users, financial services leaders must deliver both the personalized services of a neighborhood bank and the digital sophistication of an industry titan.

A great first impression. A lasting customer relationship.

Where good digital tools become great customer experiences

4 out of 5 customers prefer to digitally manage their finances – and 41% want more personalized recommendations or information from their banks.1

LaunchPoint is the leading “one-and-done” onboarding solution that does it all in one session: verifies customers and selects and activates their products. With no lag time and no delay, customers have no reason to abandon the funnel.

In just minutes, potential customers become active customers – and stay active, thanks to meaningful engagements that help them reach their financial goals.

How LaunchPoint Works

LEARN MORE

Rulesware Talks Video Series

On our Rulesware Talks video series, we were fortunate to sit down with Pierre Habis, founder of PurePoint and digital banking model pioneer. In this rare interview he discusses the common mistakes banks often make in the pursuit of digital transformation and shares the new industry opportunities and trends through 2023 that every financial services leader needs to know.

Downloads & Assets

Share

Easy Efficiency for Your Staff

Flexible Configuration Options

- Product Management: Built-in flexibility lets you adjust runtime behavior - no IT needed.

- Customer Self-service: Customers can apply, check status, add documents and correct errors on their timetable.

- Delegated control: You define the rules and behaviors to drive product recommendations.

- Decisioning: Highly customizable framework applies your preferences for work routing and prioritization.

- Risk Engine: Design and configure your own proprietary risk engine and automate the entire risk lifecycle.